Compliance. Structured. Protected. Operated.

Disciplined AML, CFT & Risk Management Solutions for UAE Businesses

Trusted Advisors for Financial Growth

Delivering expert accounting, taxation, and compliance solutions tailored to businesses across the UAE.

Your Journey to Financial Confidence

A personalized approach to accounting, compliance, and strategic advisory—supporting your business at every stage.

Trustpilot

Trustpilot

Excellent

4.9 Rating 1000+ Reviews

25

+

Years of experience

200

+

Dedicated team

1500

+

Audit completed

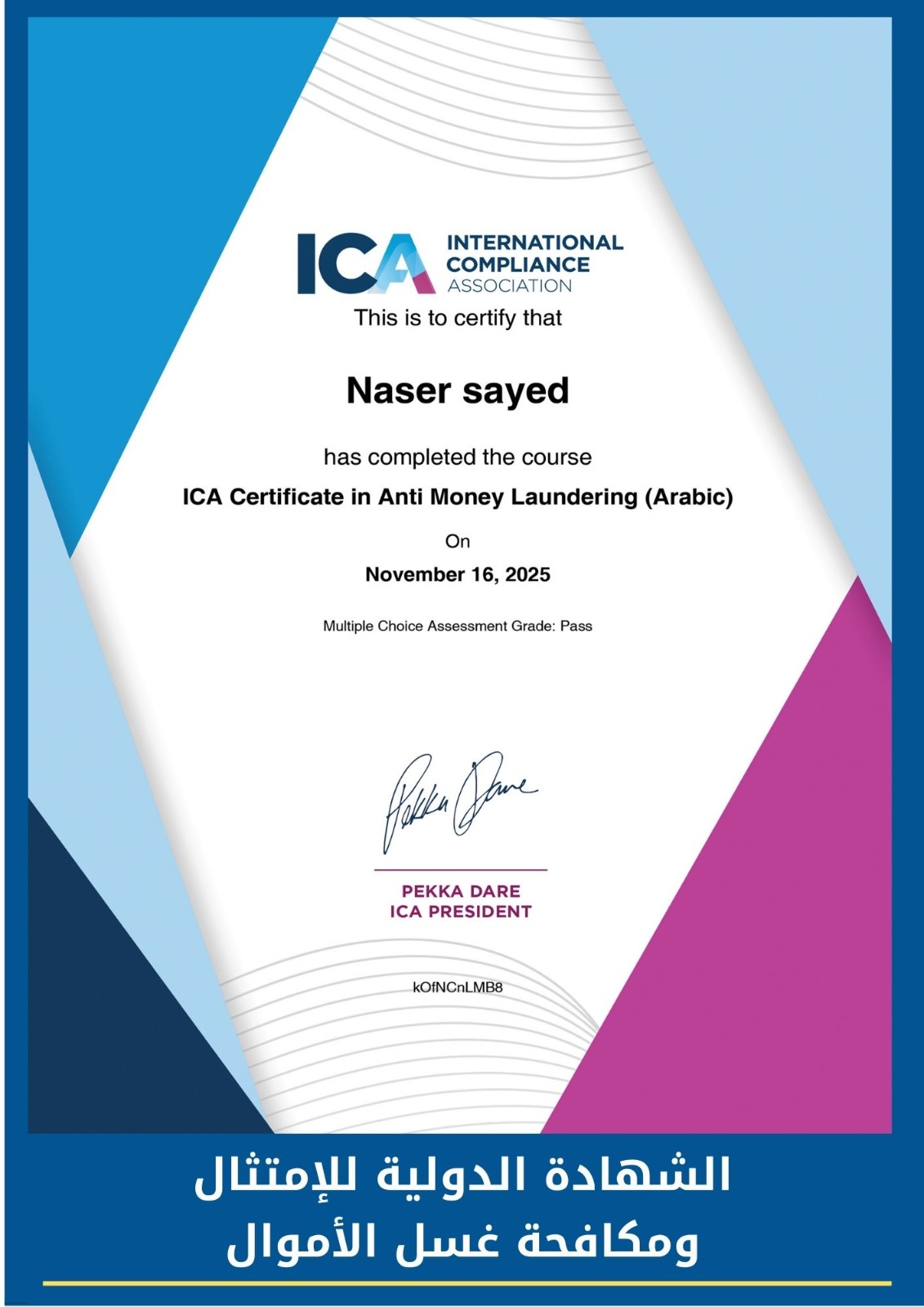

About DRM Diligence Risk Management

We specialize in AML/CFT compliance, goAML reporting, risk assessments, and regulatory advisory services.

Award Wining Company

25+ Awards Earned

Core values

Our work is built on integrity, precision, and regulatory discipline. Every framework we design is tailored to your industry, operational risk, and regulatory obligations. By combining deep technical expertise with structured governance practices, DRM enables organizations to operate confidently, securely, and in full compliance across every regulatory touchpoint.

More About Us

Trusted Compliance & Advisory Experts in the UAE

We're more than a company — we're a movement.

DRM is a specialized compliance and regulatory services company providing end-to-end goAML implementation, AML/CFT compliance, and regulatory reporting solutions. We support businesses in meeting local and international anti-money laundering regulations efficiently, accurately, and on time. With deep industry knowledge and a practical approach, DRM helps organizations reduce compliance risk, avoid penalties, and build strong internal AML frameworks aligned with regulatory requirements.

At DRM, we believe that success is built on innovation, teamwork, and trust. From humble beginnings to remarkable achievements, our journey reflects our commitment to excellence in every step we take. As we continue to expand our horizons, our focus remains on creating sustainable solutions, delivering value to our clients, and empowering our people. Together, we strive to turn every challenge into an opportunity and every idea into a lasting impact.

Dr. Naser Boltia

Chief Executive Officer DRMWe work closely with our clients to ensure smooth reporting, strong AML frameworks, and long-term compliance success.

Integrity

We uphold the highest ethical standards, ensuring complete transparency in every compliance process.

Accuracy

Every document, report, and framework is built with precision and aligned with regulatory expectations.

Protection

We safeguard your business from financial exposure, violations, and regulatory risk.

Reliability

Clients rely on us as a long-term compliance partner delivering consistent results.

Excellence

We continuously refine our methods to deliver world-class compliance and risk strategies.

Our Compliance & Risk Management Services

goAML Registration & Reporting

Complete setup, reporting, and FIU compliance.

KYC and CDD Frameworks

Risk-based client verification and due diligence systems.

Risk Assessments

Identification, evaluation, and mitigation of regulatory and operational risks.

Policies & SOP Development

Custom AML/CFT manuals aligned with UAE laws.

We're trusted by over 500 business

Achieving long-term goals with a balanced portfolio

A balanced portfolio enables clients to achieve their long-term financial goals through prudent investment diversification.

How diversified investments safeguarded wealth

Diversified investments effectively shielded wealth against market volatility, ensuring stability and growth over time.

How strategic planning transformed a client’s financial future

Strategic planning significantly enhanced a client's financial outlook, paving the way for sustainable growth and security.

Planning early for a comfortable retirement

Strategic early retirement planning helps build a solid financial foundation for a comfortable and worry-free future.

Ensuring family legacy and financial security

Effective estate planning ensures the preservation of family assets and financial security for future generations.

We support DNFBPs across the UAE in meeting AML and CFT regulatory requirements with clarity and confidence. Whether you are establishing your compliance framework or strengthening existing controls, our specialists help ensure full regulatory alignment while keeping your business prepared for audits at all times.

goAML Registration & Setup

We handle end-to-end goAML registration with the UAE FIU, ensuring your business is properly enrolled, configured, and ready for mandatory reporting without delays or errors.

Customized AML Policies & Procedures

We develop AML/CFT policies tailored to your business activity, risk exposure, and regulatory obligations, ensuring full compliance with UAE laws and international standards.

Periodic AML & CFT Compliance Reporting

Our team prepares and submits required AML/CFT reports on a periodic basis, helping you meet ongoing regulatory requirements while reducing internal workload and compliance stress.

AML Compliance Framework Implementation

We design and implement a complete compliance framework defining roles, responsibilities, internal controls, and escalation procedures aligned with UAE regulatory expectations.

Risk Assessment, KYC & Due Diligence

We assist in conducting business risk assessments, customer due diligence, and KYC reviews using a risk-based approach to identify, evaluate, and mitigate financial crime exposure.

Regulatory Inspection & Examination Support

Facing a regulatory inspection or supervisory review? We prepare your documentation, internal processes, and staff to confidently handle inspections and regulator queries.

Sanctions & Watchlist Screening

We implement effective sanctions screening mechanisms to identify prohibited individuals, entities, and transactions, helping prevent exposure to sanctioned or high-risk parties.

Regulatory & Suspicious Activity Reporting

We ensure accurate and timely submission of goAML, TFS, and other regulatory reports to help you avoid penalties, fines, and compliance breaches.

What our customers think about us

“DRM provided clear guidance and handled compliance professionally. The process was smooth and well managed.”

Ahmed Al-Mansoori

Client“Professional, responsive, and knowledgeable team. We highly appreciate their ongoing compliance support.”

Khalid Al-Nuaimi

CEO & Founder“Excellent service with attention to detail and compliance accuracy. Their structured approach saved us valuable time.”

Aisha Al-Suwaidi

Co-Founder“Reliable consultants with a deep understanding of UAE regulations. Communication was clear and consistent.”

Mohammed Al-Hammadi

Creative Director“Clear guidance, fast execution, and complete compliance. DRM made AML simple for our business.”

Abdullah Al-Shehhi

Lead Designer“DRM simplified a complex compliance process for our business. Their expertise made a real difference.”

Aisha Al-Suwaidi

ClientOur expert team members

Shane Steinberger

Founder

Stephanie Pry

CFO

Laura Crooks

COO

Shane Steinberger

CFOGet a Free quote today

Head office

- Dubai, UAE

- info@drmuae.com

- +(971) 4 355 36 76

Excellent

4.9 Rating 1000+ Reviews

Questions & Answers

All Financial Institutions (FIs) and Designated Non-Financial Businesses and Professions (DNFBPs) must comply with UAE AML/CFT laws. This includes real estate brokers, auditors, accountants, lawyers, corporate service providers, dealers in precious metals and stones, tax consultants, virtual asset service providers, and high-value goods traders.

Yes. DNFBPs are required to register with the UAE Financial Intelligence Unit (FIU) through the goAML portal and maintain ongoing reporting of suspicious transactions as part of regulatory compliance.

DNFBPs must: Register on goAML Conduct risk assessments Implement AML policies and procedures Perform Customer Due Diligence (CDD) and Know Your Customer (KYC) Monitor transactions Screen clients against sanctions lists File Suspicious Transaction Reports (STRs) when required Maintain proper records

Non-compliance can lead to heavy fines ranging from AED 50,000 to AED 5 million, business license suspension, blacklisting, reputational damage, and possible legal action depending on the severity of violations.

An AML risk assessment identifies potential money laundering and terrorist financing risks within your business operations, clients, and transactions. It helps design a risk-based compliance framework that meets UAE regulatory expectations and prevents violations.